Purchase Cycle :

When a Item is purchased in MS Dynamics NAV using purchase order and purchase invoice some accounts are credited and other accounts are debited. So for functional side we must know what is the major impact. Let's see the impact in detail.

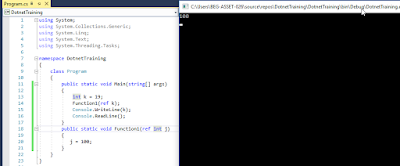

Step 1. Create an Item.

Choose any of the default Item Template to complete the Item Setup.

Step 2. Create Purchase Quote and click on Create Order.

Once this is done your quote will be converted to Order and we are receiving the order and now we will check what is the impact of receiving on accounting level.

+ in NAV means Debit and - means Credit for accounting purpose only.

For Inventory concept of sign is same.

Step 3 : When we receive a PO there is no impact on Accounting Side.

Step 4 : Lets post the Receipt using purchase Invoice Page.

When we post the invoice we get this final result.

In this final result we will check the COA in GL Entry which Account is debited and which account is credited.

1.G/L Entry :

Vendor Account Credited by 750

and

Purch. Payable Account is debited by 600 and VAT 150

What is the impact of payment for vendor invoice on G/L Account?

Now, vendor account is debited

5410 is debited by 750

&

5310 Liability Account is credited by 750.